Who doesn’t love a great business success story?

One of the things that fascinate me about business is seeing people create something from nothing into a living breathing business that makes money.

The making of the money part is the most crucial aspect of a business.

The only way to know if a business is successful is if it makes money.

The making money aspect is the real differentiator between an expensive hobby and a business.

There are plenty of people who start businesses but don’t develop the chops to become successful in the marketplace.

Notice I said develop the chops – one doesn’t need to have the chops when they start their business.

The great thing about business is it gives us the opportunity to grow and develop into something bigger and more successful.

There are many pieces of the puzzle of business that must fit together to get a business to profitability.

Make no mistake about this unless a business is profitable (meaning the business has cash in the bank), the business is not a business.

It is an expensive hobby.

I don’t care how much you love your business.

I don’t care how much your sales increase each month or each year.

I don’t care how good you are to your employees.

I don’t care how loyal your customers are.

I don’t care how many fans your company has on Facebook.

I don’t care how many hours you put into your business.

Unless your business is putting more cash into the bank than it spends each month, your business is not a business.

It is an expensive hobby.

The most important metric that matters in business is cash in the bank.

The primary goal of the business owners must be profitability (aka more cash in the bank at the end of the month than at the end of the month.)

Why is it so important that a business makes money?

If people aren’t willing to spend money for what we’re selling, then those products and services are not valuable enough.

It doesn’t meet the needs or desires in the people’s minds that makes it worth them trading their money for those goods/services.

When products and services don’t sell, the marketplace is giving us a failing grade on those products and services.

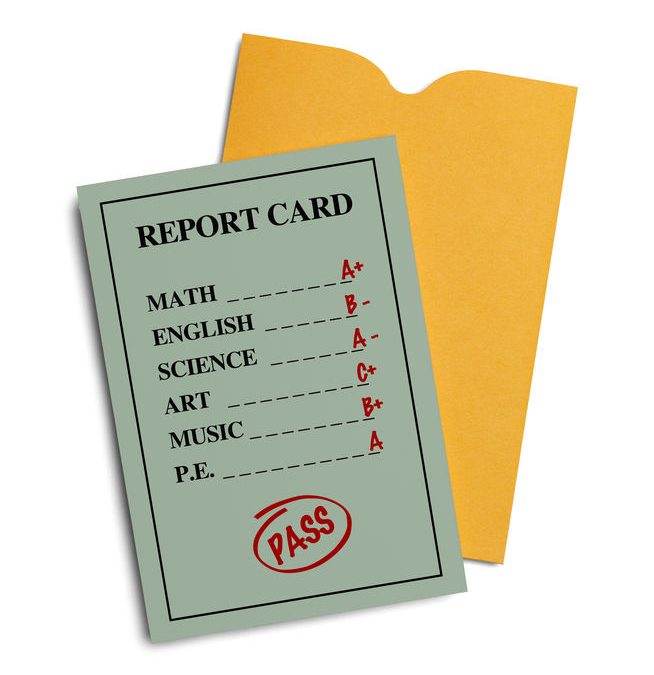

Cash in the bank is like a report card for your business.

Think about how simple the report card made school life.

How did I know if I was successful at the end of a semester in my classes?

I looked at my grades on my report card.

Where I grew up, we had the A, B, C, D, F grading system

If I got an A, B, C, or D, I passed the class.

If I got an F in the class, I failed the class.

F stood for fail in my mind.

A was the best grade I could get in each of my classes.

I was a pretty good student and got mostly As and Bs on my report cards.

The great thing about the grading system in school was that it was a simple system that anyone could understand.

Each semester I took around five classes.

If I had taken twenty classes, I would have had too much on my plate.

I would have become overwhelmed.

I would have spent too much time switching my focus from one class to another that my energies would have become divided among too many things.

Having five or fewer things to focus on is a manageable amount to work with.

Anything more than five items and our effectiveness dwindles dramatically.

Here we have a simple template for success that has helped hundreds of millions of people navigate the education system.

People from various socioeconomic backgrounds, nationalities, geographic locations, and abilities have been educated by a system that used a simple formula to gauge academic success.

Here are the two keys the school system uses:

- Limit learning to five subject areas at a time

- Have a simple grading system that anyone can understand

Let’s apply this proven system to business.

Let’s give ourselves a simple and effective way to grade the success of our business.

We will start with focus areas.

Here are the four areas to focus on your business.

- Owner

- Operations

- Money

- Sales/Marketing

Become a master of each of these areas of business, and you will become successful at business.

Each of these four areas is important to business.

Some people may say one area is more important than the other.

Remember, though that success in business should be viewed as putting pieces of a puzzle together.

Each of the puzzle pieces must be included to make a complete picture.

Now that we have the four areas of focus for our business, we need a simple, effective way to record our success in business.

Let’s go back to my previous statements about what makes a business successful.

The only way to know if a business is successful is if it makes money.

Money is a great system to judge our success.

When we have more cash in the bank each month than we had in the prior month, it means that we are successful in our business.

Here are the only two relevant factors that affect the amount of money we have in our business bank accounts.

- Earning money through selling goods and services

- Spending money

With these two factors, we can start to diagnose where problems exist when we don’t have enough money in our bank accounts.

When a business doesn’t have enough cash, it is tied to one of the following three scenarios:

- The business isn’t selling enough.

- The business is spending too much.

- The business isn’t selling enough, and the business is spending too much.

Those are the only three scenarios that lead to a business depleting is cash.

Now I’m going to give you a simple way to judge your business health without needing to consult a bookkeeper, accountant or CPA.

Look at the past three months of your business bank statements.

On a piece of paper, create three columns.

At the top of each column, write the name of the last three months.

For example, we are now in January.

I would have a column for December, November, and October to list my last three months.

Now I’m going to create three rows.

The first row is deposits – this indicates the amount of money that came into the business during a month.

The second row will be payments – this indicates the amount of money that left the business during a month.

The last row will be cash remaining.

Here are the steps you will now take.

For the deposit row, write down the total deposits the business received for each month.

You can easily find the deposits number on the first page of your bank statements.

Next, in the payments, write down the total payments the business made for each month.

You can easily find that payments number on the first page of your bank statements.

Some banks will separate the payments number between checks and payments/withdrawals.

Make sure to use a sum of payments/withdrawals for your payments row.

For example, if you had $5,000 in checks and $3,000 in payments, your total payments would be $8,000.

Now we move onto the cash row.

This is where we will apply a little math.

You need to subtract the payments from the deposits.

Let’s say the business had $10,000 in deposits and $8,000 in payments.

Then our cash remaining row would be $2,000.

If the cash remaining row is positive, then your business was successful that month.

If the cash remaining row is negative, then your business failed that month.

Now you have a simple system for grading your business as a success or a failure.

Recent Comments